Ready for Financial Wellness?

Tired of the same old cycle of debt and financial stress?

At Save SA Money, we’re rewriting the narrative. If you are over-indebted and struggling to keep up with your monthly repayments, we’re here to help.

What We Do

Guiding You Towards Financial Freedom

From Concept to Completion, and everything in between. Your journey towards financial freedom with Save SA Money is straightforward and empowering. Here’s how we guide you every step of the way:

Guiding You Towards Financial Freedom

From Concept to Completion, and everything in between. Your journey towards financial freedom with Save SA Money is straightforward and empowering. Here’s how we guide you every step of the way:

Obligation-Free Assessment:

Taking the First Step Towards Financial Freedom

Take the first step towards a brighter financial future by completing our callback form for an obligation-free assessment. Our friendly and experienced consultants are here to listen, understand your unique circumstances, and provide insights tailored to your needs. There’s no pressure or commitment—just a supportive conversation to help you explore your options.

Personalised Proposal:

Crafting Your Roadmap to Financial Freedom

After understanding your financial challenges, our dedicated debt counsellor will craft a personalized payment proposal designed specifically for you. This proposal is your roadmap to debt relief and financial stability, carefully crafted with your goals and aspirations in mind. Take your time to review it thoroughly and feel confident knowing that it’s tailored to your needs.

Our Financial Wellness Services: Leading You Towards Financial Freedom

Debt Counselling

Debt Review Removal

Debt Consolidation

There is no one-size-fits-all approach to financial wellness. At Save SA Money, we understand the significance of personalized debt solutions.

Why Choose Save SA Money:

Your Partner in Achieving Financial Wellness

A Dedicated Team by Your Side: At Save SA Money, we understand the stress and uncertainty that comes with financial difficulties. That’s why we assign a dedicated team of debt counselling experts to your case. Specially trained to navigate the complexities of debt negotiation, our team is here to support you every step of the way.

We understand the importance of clear communication, which is why we provide multilingual assistance. Our professional and patient team will take care of you in a language you understand, ensuring that you feel comfortable and supported throughout the process.

Your confidentiality is paramount to us. Throughout your entire experience with us, you can rest assured that your information is safe and secure. We take your privacy seriously and guarantee that your information remains confidential and known only to us.

There is no one-size-fits-all approach to financial counselling. At Save SA Money, we understand the significance of personalized debt solutions. We thoroughly examine your financial situation to provide tailored guidance for your journey towards financial freedom.

Ensuring Success and Peace of Mind: Our ultimate goal is your financial success and peace of mind. Once your resolution is finalized, we provide you with a clear outline of the terms and monitor your account for any post-resolution errors. Additionally, we equip you with a personalized plan to help you stay financially stable moving forward.

– While under debt counselling, creditors can’t bother you for payment or take legal action for included debts.

– There are costs for debt counselling, but they’re fair and regulated.

– Completing debt counselling successfully helps manage money better and prevents future financial issues, giving you and your family a fresh start!

Contact Us For Personalized Guidance

Why Financial Wellness?

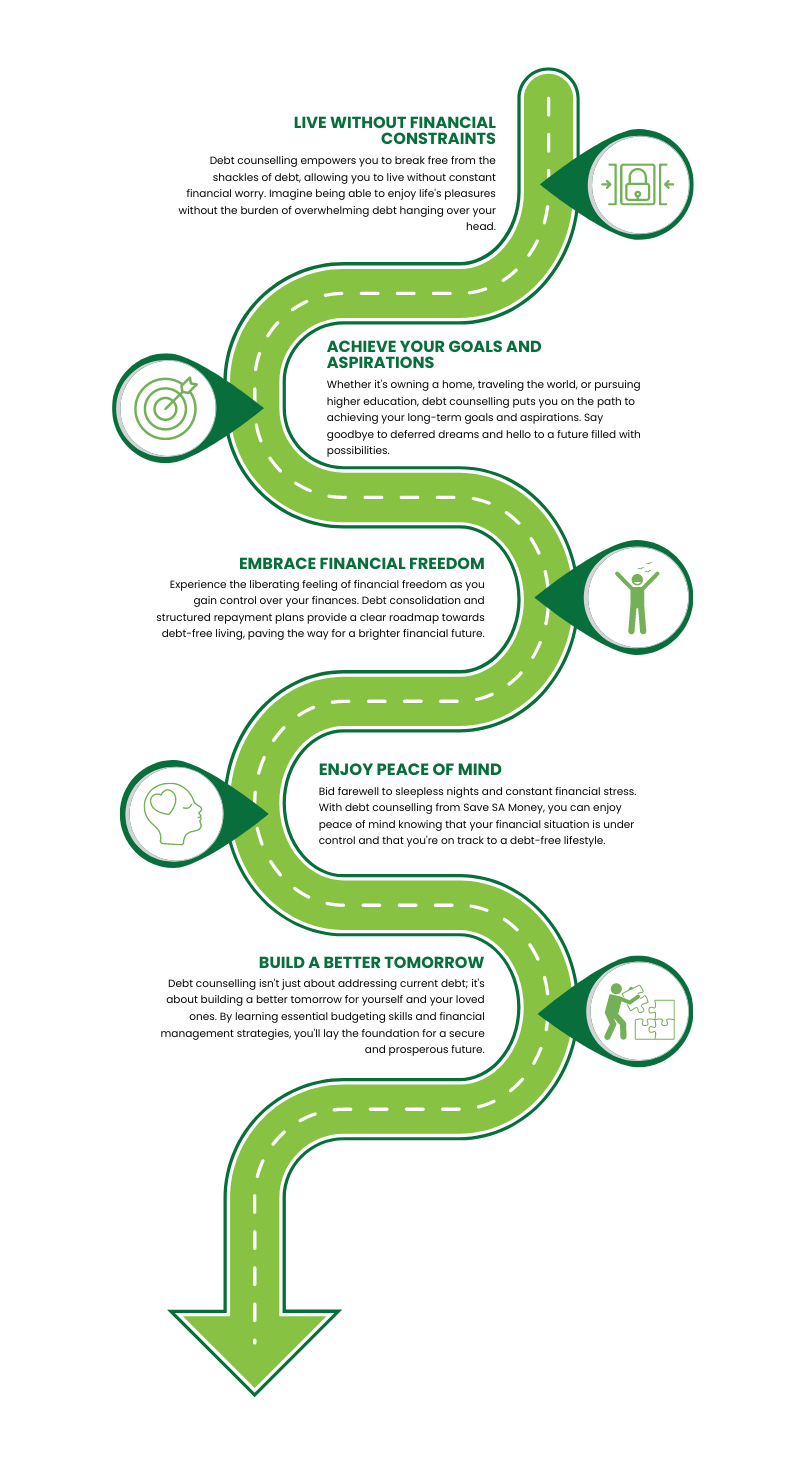

Debt counselling isn’t just about managing debts; it’s about unlocking the lifestyle you’ve always dreamed of but couldn’t attain due to financial constraints. Here’s how Save SA Money’s debt counselling services can turn those dreams into reality:

1

Live Without Financial Constraints

Debt counselling empowers you to break free from the shackles of debt, allowing you to live without constant financial worry. Imagine being able to enjoy life’s pleasures without the burden of overwhelming debt hanging over your head.

2

Achieve Your Goals and Aspirations

Whether it’s owning a home, traveling the world, or pursuing higher education, debt counselling puts you on the path to achieving your long-term goals and aspirations. Say goodbye to deferred dreams and hello to a future filled with possibilities.

3

Embrace Financial Freedom

Experience the liberating feeling of financial freedom as you gain control over your finances. Debt consolidation and structured repayment plans provide a clear roadmap towards debt-free living, paving the way for a brighter financial future.

4

Enjoy Peace of Mind

Bid farewell to sleepless nights and constant financial stress. With debt counselling from Save SA Money, you can enjoy peace of mind knowing that your financial situation is under control and that you’re on track to a debt-free lifestyle.

5

Build a Better Tomorrow

Debt counselling isn’t just about addressing current debt; it’s about building a better tomorrow for yourself and your loved ones. By learning essential budgeting skills and financial management strategies, you’ll lay the foundation for a secure and prosperous future.

How Does Debt Counselling Work?

Reach Out for Help

Take the first step towards your dream lifestyle by contacting a registered debt counsellor.

Get an Assessment

Receive personalized guidance tailored to your unique financial situation and aspirations.

Let the Debt Counsellor Do Their Work

Trust in our expertise as we negotiate with creditors and craft a tailored debt repayment plan.

Make One Monthly Payment

Experience the convenience of a single monthly payment, simplifying your financial management.

Keep in Touch and Adjust if Needed

Stay connected with your debt counsellor for ongoing support and plan adjustments as your lifestyle evolves.

Finish Strong and Live Your Dream

Celebrate your journey to financial freedom with a clearance certificate and a newfound sense of empowerment.

At Save SA Money, we’re committed to helping you unlock the lifestyle you deserve. Say goodbye to financial constraints and hello to a life filled with possibilities.

Frequently Asked Questions

How does debt counselling work?

Debt counselling involves reaching out to a registered debt counsellor who assesses your financial situation, negotiates new payment terms with creditors, and creates a structured repayment plan tailored to your needs.

Can I still apply for credit while under debt counselling?

While under debt counselling, you may not apply for additional credit. However, once you’ve completed the debt

Who doesn't qualify for debt review?

If you have no income at all, a debt review may not be possible because there are no funds to work with. However, do not lose hope. A debt counsellor can advise you on other options, which may include arranging for a temporary pause on debt repayments until you find employment.

Can anyone apply for debt review?

Any consumer can apply for debt counselling, upon which an assessment will be done to determine the state of over indebtedness. If a consumer is found to be over indebted, the Debt Counsellor will negotiate with the creditors to have the monthly instalments reduced and increase the term of instalments, there could be a possible agreement to reduce the interest rates.

Key Points to Note:

A client can’t apply for new credit while under Debt Review.

Once placed under debt review, the consumer will be listed in the credit bureaus as such, which credit providers will check, however upon debt settlement, the consumer will receive a clearance certificate which will remove the consumer’s status.

The repayment term will vary based on the amount of debt the consumer has, which can go on to a maximum of 5 years.

What is the aim of a Debt Counsellor?

The aim of a Debt Counsellor includes:

- Protection against legal action by Credit Providers.

- Assessing the full extent of the consumer’s debt situation.

- Assessing the consumer’s assets that may be considered.

- Providing a debt solution so that the consumer may have an acceptable standard of living while paying off his/her debt.

- Providing the consumer with an agreed, affordable, and realistic monthly budget in order to resolve the situation in the shortest possible time.

- Providing a repayment plan acceptable to the consumer, creditors, and confirmed by the Court.

- Preventing repossession of assets where possible.

- Rehabilitating the consumer and allowing the consumer to get on with his/her daily life.

Is debt counselling a good idea?

Absolutely! Debt counselling can provide invaluable support and guidance for individuals struggling with debt. It offers a structured approach to managing debts and can lead to financial stability and peace of mind.

Will debt counselling negatively impact my credit score?

While debt counselling may initially reflect on your credit report, it’s viewed as a positive step towards responsible debt management. Over time, as you adhere to the repayment plan, your credit score can improve.

Are debt management plans worth it?

Yes, debt management plans can be highly beneficial for individuals facing overwhelming debt. They provide a structured repayment strategy, often with reduced interest rates and fees, making it easier to manage debt and work towards becoming debt-free.

Is debt counselling free?

In many cases, initial consultations with debt counsellors are free of charge. However, it’s essential to clarify any potential fees or costs associated with ongoing debt counselling services before proceeding.

What are debt counsellors?

Debt counsellors are qualified professionals who specialize in helping individuals manage and overcome debt. They assess your financial situation, negotiate with creditors on your behalf, and provide tailored debt management solutions.

How long does financial wellness take?

The duration of debt counselling can vary depending on the complexity of your financial situation and the effectiveness of the debt management plan. On average, the process can take several months to a few years to complete.

Why is debt management important?

Debt management is crucial for regaining control of your finances and working towards a debt-free future. It helps you prioritize repayments, negotiate favourable terms with creditors, and ultimately achieve financial stability.