Our Debt Counselling Services

Leading You Towards Financial Freedom

We’re here to offer our expert debt counselling services, tailored specifically to your unique financial situation. At Save SA Money, we understand the weight that financial stress can carry and the impact it can have on your life.

Debt Counselling

Whether you’re grappling with mounting debt or aiming for proactive financial management, our counsellors are here to lend an ear, offer support, and equip you with the tools for a brighter financial tomorrow. Contact our experienced debt counsellors now to kickstart your path to financial freedom. The skilled team at Save SA Money is dedicated to delivering personalized assistance and guidance, tailored specifically to your financial circumstances.

With our expert advice and support, you can:

Reduce Financial Stress

By creating a structured repayment plan, we help alleviate the stress of overwhelming debt, allowing you to focus on rebuilding your financial health.

Improve Credit Score

Our debt counselling services can help you improve your credit score by establishing a disciplined repayment schedule and negotiating with creditors on your behalf.

Gain Financial Freedom

Through effective debt management strategies, you can regain control of your finances and work towards a debt-free future, paving the way for long-term financial stability.

Debt Review Removal

We recognize that being under debt review can be tough and stressful. Various factors can complicate meeting creditor deadlines, keeping you stuck in debt review. With our help and debt review removal solution, you can focus on your life goals while we work on improving your credit score.

Our debt review removal service offers a pathway to financial freedom, empowering you to:

Escape Debt Review Restrictions

Say goodbye to the limitations of debt review and regain control of your finances, allowing you to pursue your life goals without hindrance.

Rebuild Creditworthiness

By removing the stigma of debt review from your credit record, we help you rebuild your creditworthiness and regain access to financial opportunities.

Achieve Peace of Mind

Experience the relief of being free from debt review, knowing that you’re on the path to a brighter financial future with Save SA Money by your side.

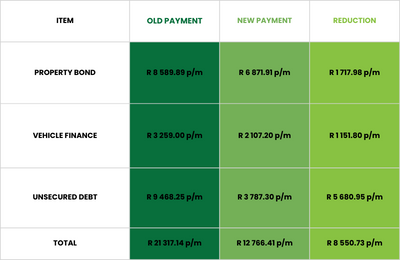

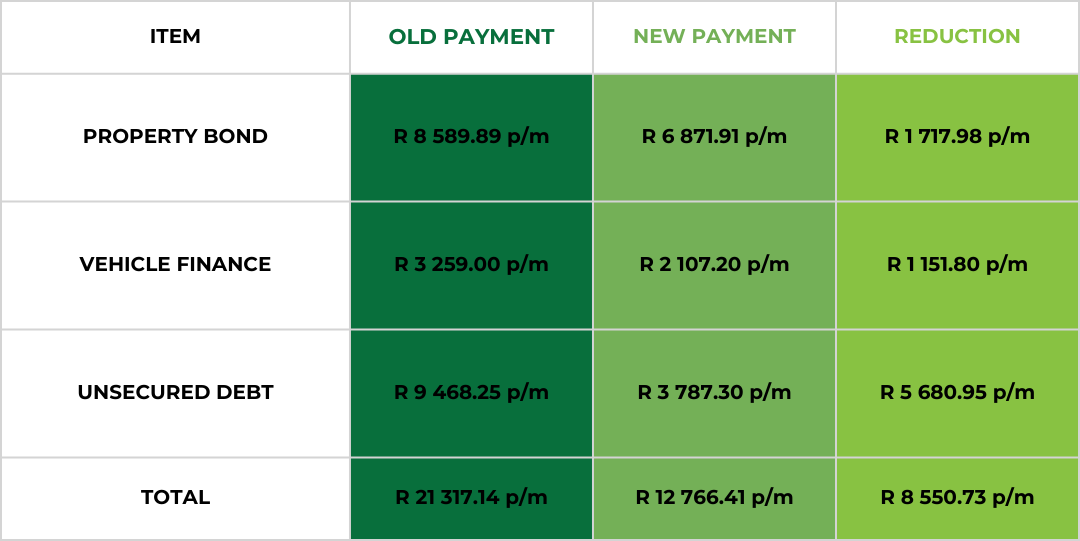

Debt Consolidation

Consolidate debt for simplified finances, merging repayments into one. In today’s economy, household finances face immense pressures, fuelled by pervasive marketing. Credit offers allure, but debt slowly mounts, overwhelming many. With 12 million South Africans burdened by debt, consolidation through counselling offers hope for financial recovery.

Consolidating your debt with our expert guidance offers numerous benefits, including:

Simplified Financial Management

Merge multiple debt payments into a single, manageable monthly instalment, making it easier to keep track of your finances and avoid missed payments.

Lower Interest Rates

Through debt consolidation, you may qualify for lower interest rates, reducing the overall cost of your debt and saving you money in the long run.

Faster Debt Repayment

With a structured repayment plan in place, you can accelerate your journey towards debt-free living, freeing yourself from the burden of debt sooner than you thought possible.